Can anyone make ₹1 Crore by investing just ₹100 per day in SIP? Calculate it below.

SIP Calculator by Smartin Enter your investment details (SIP or LumpSum) and instantly calculate your returns. Adjust for inflation, MF Expense Ratio, Step-up, LTCG, and calculate Growth Percentage to fine-tune your corpus. Download a personalized PDF report.

SIP Return Results

Invested Amount:

Estimated Returns:

Final value of Investment:

Inflation-Adjusted value of Investment:

Your investment has grown by over years.

Invested Amount:

Estimated Returns:

Total value of Investment:

Inflation-Adjusted value of Investment:

Your investment has grown by over years.

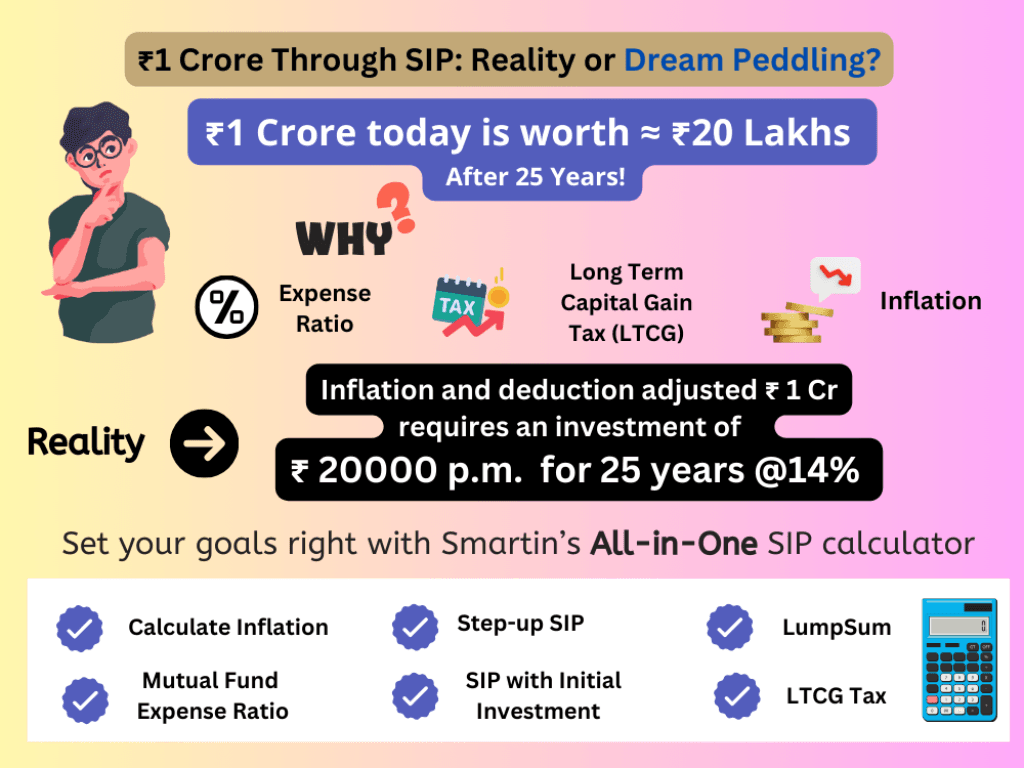

While a monthly investment of ₹3,045 may (take it with a grain of salt) help you reach ₹1 crore in 25 years, have you considered the real value of this ₹1 crore after a few decades? It would be worth only ₹20 lakhs in today’s terms, due to inflation and deductions associated with mutual fund investments, like LTCG and expense ratios.

SIP in mutual funds can definitely help grow your wealth, but the return estimates claimed on that reel you saw on Instagram present only half the truth. That’s why I have designed this SIP calculator to give you a realistic picture of how much your investment would grow.

Hey thanks for visiting, I’m Smartin. As a mutual fund investor myself, I’m here to help people getting misled by those fin-influencers, who often share exaggerated SIP return figures to lure customers into Mutual Funds, in return of consultation fees and commissions. This SIP calculator will help you plan your investments without anyone’s help. For accuracy, I have verified the calculations with popular MF platforms like Groww. Read on to learn how to use this tool—I’ll also share many insights and use cases along the way.

What is a SIP Calculator for Mutual funds?

A Systematic Investment Plan (SIP) as the name suggests is a disciplined way of investing your money regularly in a financial instrument to create long-term wealth. Think of it as similar to a recurring deposit (RD) in a bank, where you deposit a fixed amount monthly, and the interest rate is declared upfront. Although SIPs and RDs follow a similar process, SIPs are long term and more associated with investments in stocks, mutual funds, gold, etc., where returns are usually market-linked and not guaranteed. Since returns from SIPs in mutual funds are not guaranteed, we need to use a SIP calculator to estimate the expected performance of our investments and plan our goals accordingly.

However, when using a SIP calculator, it’s important to exercise caution to avoid overestimating the potential returns. Real returns can be affected by various factors, including inflation, deductions and the fees charged by distributor platforms and fund houses.

A SIP calculator, like ours, helps you accurately determine the future value of your Mutual fund investment by inputting basic details such as the planned SIP amount, timeframe, and the expected rate of return (CAGR). Using this tool allows you to plan how much you may want to invest to meet your future goals, such as buying a house, funding your child’s education, marriage, or retirement.

Features of Smartin’s All-In-One SIP Calculator.

The popular and mainstream SIP calculators out there do not provide options for inflation adjustment and deductions, and that is why we developed Smartin’s SIP calculator. Yes, there are separate tools for checking inflation, lump sum, and step-up scenarios, but to use them, customers have to copy the results from one calculator to another and combine them to make a decision – which can be difficult without professional assistance. We offer everything in a single window, making our application all-in-one and a perfect alternative. Have a look at the features.

- SIP Return Calculation.

- LumpSum Investment Calculation.

- Inflation adjustment.

- SIP with annual Step-up

- SIP with Initial Investment.

- MF Expense Ratio.

- LTCG Tax.

- PDF Report generation.

- SIP annual growth table.

- Step-up SIP amount (annual change) calculation.

- Total Growth in percentage.

- Graphical illustration.

- Offline & mobile Support.

Even a beginner without any prior knowledge can rely on Smartin’s SIP calculator to find their investment outcome. We will go through each feature in detail, how to use it, and the calculation logic behind the estimations, in the upcoming sections.